Bank of the Philippine Islands (BPI), via a Facebook post, has announced that cash-in transfers from BPI Mobile to GCash and vice versa remain free of charge.

Check out the tutorials on how to perform cash-in transactions below.

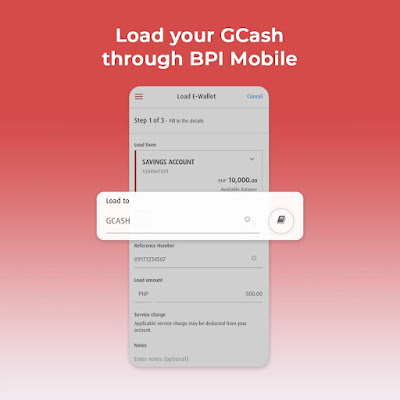

How to Cash into GCash via the BPI Mobile app

Step 1: Open your BPI Mobile app and log in to your account.

Step 2: Select ‘Payments/Load’ from the menu.

Step 3: Select ‘Load E-wallet’.

Step 4: Fill in the details and select GCash.

Step 5: Confirm the details of your transaction, then click on the ‘Confirm’ button.

Step 6: Enter your Mobile Key to approve, then select the ‘Submit’ button.

Step 7: You’re done!

How to Cash into GCash using your linked BPI account

If this is your first time, link your BPI account first:

Step 1: Log in to your GCash app, then select ‘Cash In’.

Step 2: Under Online Banks, select ‘BPI’ and tap on the ‘Enroll Now’ button.

Step 3: Enter your BPI Online username and password.

After successfully linking your BPI account to GCash, you can now cash in:

Step 1: On the GCash app’s homepage, tap ‘Cash In’.

Step 2: Under My Linked Accounts, select ‘BPI’.

Step 3: Enter the amount and select an account.

Step 4: Enter your one-time PIN (OTP), and you’re done.

With GCash being the leader in mobile e-wallet service in the Philippines, the free transfer between GCash and BPI is a great saving for Filipinos, as they will no longer have to pay transaction fees when transferring funds, unlike other banks that charge between PHP 10 and PHP 15 per transaction.

Cash-in to GCash is free of charge —BPI

Source: Magandang Gabi Viral

0 Comments