GCash Mastercard, a physical reloadable prepaid card, can be linked to your GCash wallet. It can be used to make purchases online or at stores that accept Mastercard. This card can also be used to withdraw cash from any affiliated Bancnet ATMs nationwide and Mastercard ATMs worldwide.

Also read:

With a GCash card, you can enjoy the benefits of a credit card and a debit card in one. To apply for a GCash Mastercard, you must fully verify your GCash account first. It costs 150 Pesos (suggested retail price), plus a 65 Pesos delivery fee, a total of 215 Pesos when purchased online. To get your card, check out the simple guide below.

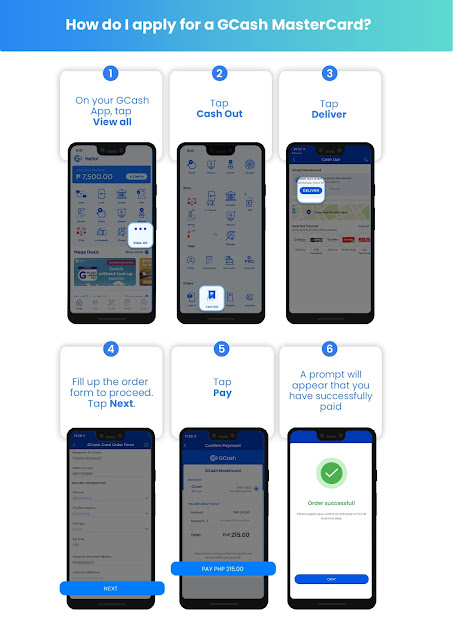

How to Get a GCash Mastercard via GCash App

You can get your GCash Mastercard by ordering it online in the GCash app. Follow the steps below.

Step 1: Open your GCash app and enter your 4-digit MPIN to log in.

Step 2: On the app's homepage, tap on 'View All'.

Step 3: Scroll down, find the 'Others' section and select 'Cash Out'.

Step 4: Tap on 'Deliver' under the GCash Mastercard section.

Step 5: Fill out the 'GCash Card Order Form' to proceed. After entering your information, check the 'I accept the Terms and Conditions' box, then tap Next.

Step 6: Tap on Pay.

Step 7: A message prompt will appear that you have successfully paid.

Step 8: Expect your GCash card to be delivered within 10 business days.

Here's the summary of the tutorial on how to apply for a GCash Mastercard.

Frequently Asked Questions (FAQs)

What are the features of GCash MasterCard?

Here are the top features of GCash Mastercard:

- EMV chip card with a 16-digit card number and a three-digit CVV

- No maintaining balance required

- Daily withdrawal limit: PHP 100,000

- Customer Protect Program that covers unauthorized transactions

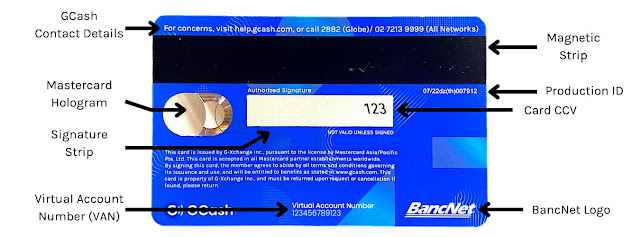

Card Design and Features

How to activate my GCash Mastercard?

To enjoy the full benefits of your GCash card, you must activate it immediately once you receive it. GCash Mastercard activation requires linking your card to your e-wallet account via the *143# menu (USSD code for Globe/TM users) or the GCash app.

Activate GCash Mastercard via *143#

1. Dial *143# on your Globe/TM phone.

2. Choose GCash > GCash Card > Activate Card.

3. Enter your GCash MPIN.

4. Enter your 16-digit GCash Mastercard number.

Activate GCash Mastercard via GCash App

1. On your GCash App, tap on Profile.

2. Select My Linked Accounts > GCash Card.

3. Tap the 'Add a Card' button.

4. Enter the 6-digit authentication code you received through SMS, then tap Submit.

5. After that, enter the last 4 digits of your GCash MasterCard number and the 12-digit Virtual Account Number (the VAN can be found at the back of your card), then tap Next.

6. Enter your nominated 6-digit PIN. Tap Next once you've confirmed and double-checked your nominated PIN.

7. An in-app prompt will appear once you have successfully linked your account.

How to set a 6-digit card PIN for my GCash Mastercard?

Remember that your MPIN is different from your card PIN. The 4-digit MPIN is the password for your GCash transactions, while your 6-digit card PIN is used for ATM withdrawals and terminal payments, among others. Here are the steps to set your 6-digit card PIN.

1. In your GCash App, tap Profile.

2. Tap My Linked Accounts.

3. Select GCash Card.

4. Choose a GCash Mastercard account and tap Set Card PIN.

5. Input your nominated 6-digit PIN. Enter the same PIN on the next line and tap Next.

6. A pop-up message will appear to confirm that the PIN setup was successful.

How to reset my GCash Mastercard PIN?

When you have already set a 6-digit card PIN for your GCash Mastercard, you can change it within the GCash app or by calling 2882 if you do not have the app on your phone. To change your PIN, follow the instructions below.

1. On your GCash App's main interface, tap Profile.

2. Click My Linked Accounts.

3. Select GCash Card.

4. Choose a GCash Mastercard account and tap Reset Card PIN.

5. Enter the 6-digit authentication code you received via SMS, then tap Submit.

6. Input your new 6-digit PIN. Enter the same PIN on the following line to confirm, then tap on the Next button.

7. An in-app prompt will appear to confirm that the Reset Card PIN setup is successful.

How to lock or unlock my GCash Mastercard?

With the lock and unlock feature, you can enable or disable your GCash card. It is a security measure that prevents unauthorized transactions. In situations where you are not using your card, you can conveniently lock it for added security. If it is lost or stolen, you can lock the card instead of deactivating your entire GCash account. Here's how you can lock or unlock your GCash Mastercard.

- To lock your GCash card, log in to your GCash app, tap on Profile, and go to My Linked Accounts > GCash Card > Lock Card. A pop-up message will appear confirming if you want to Lock your GCash Mastercard. Tap Lock Card. Once locked, it will prompt that card locking is successful. Your GCash Mastercard will be grayed out.

- To unlock your GCash card, log in to your GCash app, tap on Profile, and go to My Linked Accounts > GCash Card > Unlock Card. Enter the 6-digit authentication code, then tap Submit. A small pop-up text at the bottom of the screen will appear once you have successfully unlocked your account.

How many GCash cards can I apply for?

You're only allowed to avail a maximum of 3 Mastercards per month.

How many GCash cards can I link to my GCash wallet?

You can have multiple cards if you have several GCash wallets registered under your name. However, as per GCash Terms and Conditions, you're only allowed to link one GCash Mastercard to your GCash wallet.

How much is the GCash Mastercard ATM withdrawal fee?

According to GCash, the ATM withdrawal fee for the GCash Mastercard ranges from PHP 10 to PHP 18, depending on the servicing bank in the Philippines. Meanwhile, withdrawing your money from international locations will charge you PHP 150.

How much is the GCash Mastercard ATM balance inquiry fee?

If you inquire about your GCash card balance through ATMs in the Philippines, there is a fee of PHP 3 per transaction. On the other hand, international balance inquiries cost PHP 50.

What is the expiration date of GCash Mastercard?

Your GCash Mastercard is valid for five (5) years. Once the card expires, you can apply for a new one and get a new card number.

How to use GCash MasterCard online?

GCash MasterCard works the same as any other debit card, so long as the merchant is accepting MasterCard. Just enter the details required when paying online.

How to use GCash MasterCard for in-store purchases (offline)?

Hand over your GCash MasterCard to the cashier for payments. Some point-of-sale (POS) terminals where the card will be swiped may require you to enter your 4-digit MPIN.

For any other concerns, you may contact GCash customer service via any of the following channels:

- Email: support@gcash.com

- Hotline: 2882

- Facebook: https://ift.tt/FItlrLu

Source: GCash

0 Comments